Updates

Watch: Tax McDonald’s, Fund Child Care!

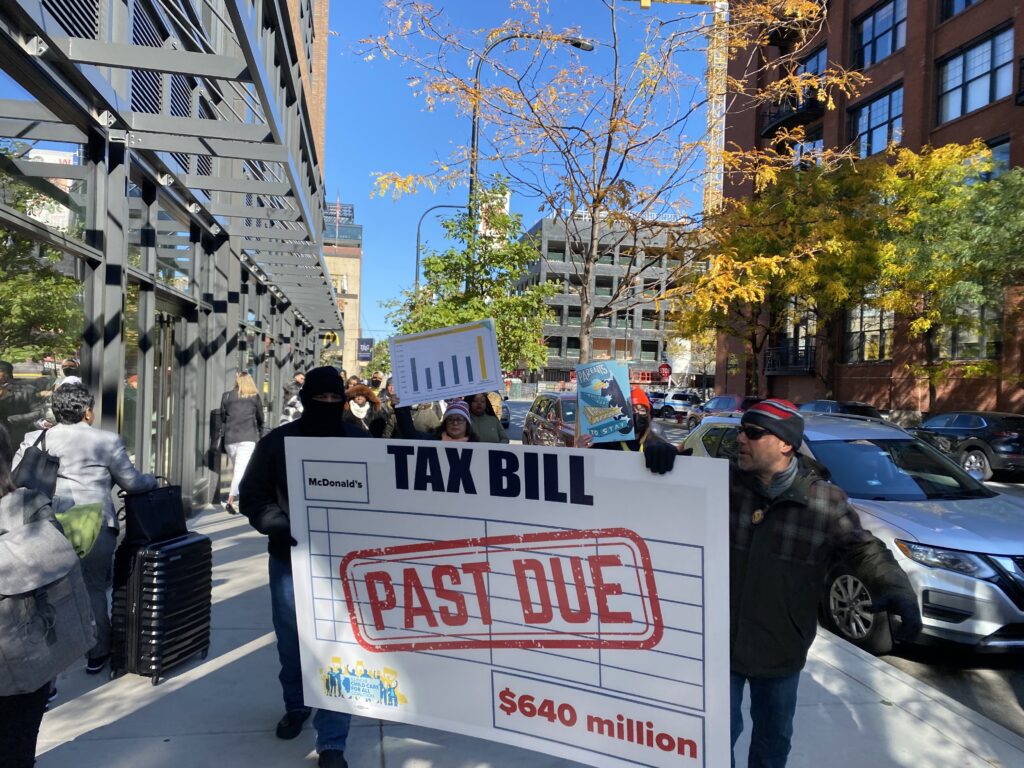

On October 19, child care providers and parents delivered McDonald’s a bill for the $640 million they have avoided in paying taxes this year alone, calling on major corporations in Illinois to pay their fair share and fund a child care system that works for all of us.

Joined by state representatives Ram Villivalam, Lakesia Collins, and Mary Flowers, our coalition highlighted the corporate tax loopholes Illinois must close to fund a universal system of free public child care for all families. “Our providers are not being paid a livable wage. Our parents cannot afford child care. They have to go to work. Everyone knows that inflation is high and wages are low. That is unacceptable,” said Representative Mary Flowers. “We must demand for our children for our future, that the educators be paid a proper wage with benefits and our children have a safe place to go to be provided a safe quality affordable education.”

“I have been a licensed provider for 17 years in the city of Chicago. During those 17 years I noticed the more that when these big corporations like McDonald’s have been given tax breaks, the more funding is taken away from our communities. Over the years, resources have dwindled away and have been impossible to find, especially in the south side of Chicago,” said LaTonya Mitchell, Home Child Care Provider and SEIU Healthcare Illinois member. “I do it for the children, I do it because I want to give them quality care. I do it because I love the industry. But it’s becoming harder to stay in the industry because I can’t afford things. I can’t afford simple things like buying medicine, and that shouldn’t be the case for someone in my position.”

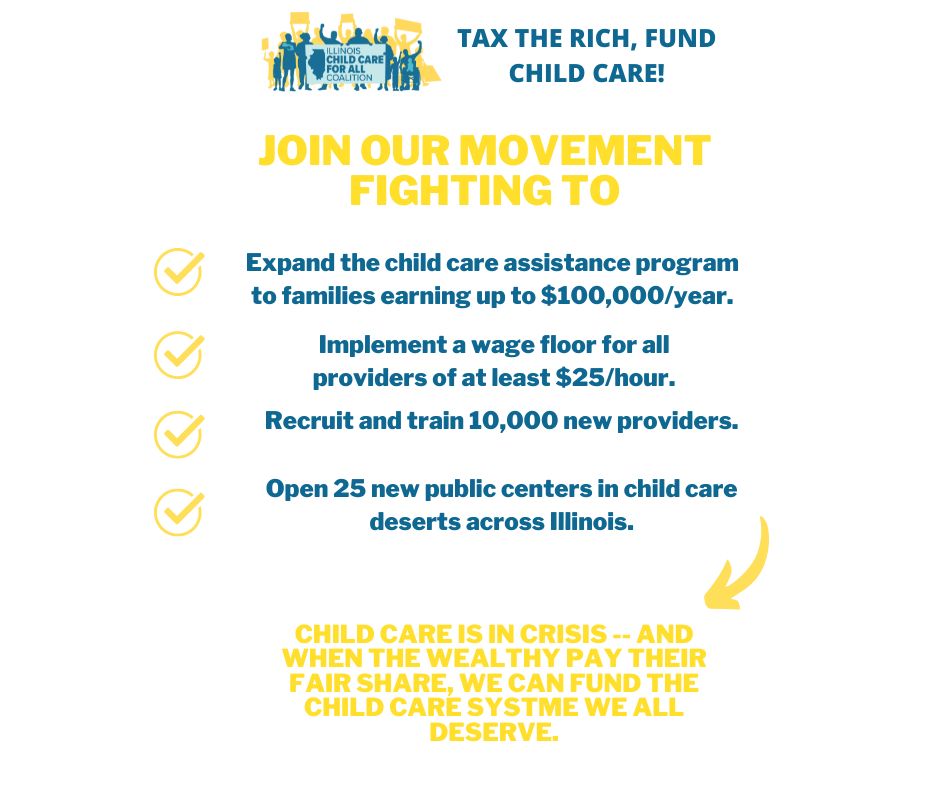

During the rally, the coalition also released a new report outlining four bold policy demands to create a child care system that works for Illinois families and child care providers alike:

Against the backdrop of McDonald’s headquarters, our movement led by parents, families and child care providers from across the state delivered a larger-than-life tax bill to McDonald’s for the $640 million that they have avoided in taxes globally just this year alone. Among Illinois parents who rely on CCAP, McDonalds is the second largest employer.

“We stand here united and say ‘no more.’ We demand that McDonald’s take their $640 million of avoided tax-paying money and invest in our child care. Invest in our children and their care. $640 million could eradicate child care debt. $640 million would pay a living wage. $640 million should position corporations like Mcdonald’s and others to not only be intentional but divested communities are deserving. $640 million will change the conditions of how we live and improve our quality of life,” said Cleopatra Draper, Illinois Parent, Southsiders Organized for Unity and Liberation (SOUL) member.